Stay ahead of the game with Industry's only Integrated Risk & Compliance Solution to supervise your team

Help wealth managers, financial advisors, and operations teams avoid mistakes, enhance business resilience and achieve long-term success.

Trusted by Leading Wealth Management Firms

How It Works

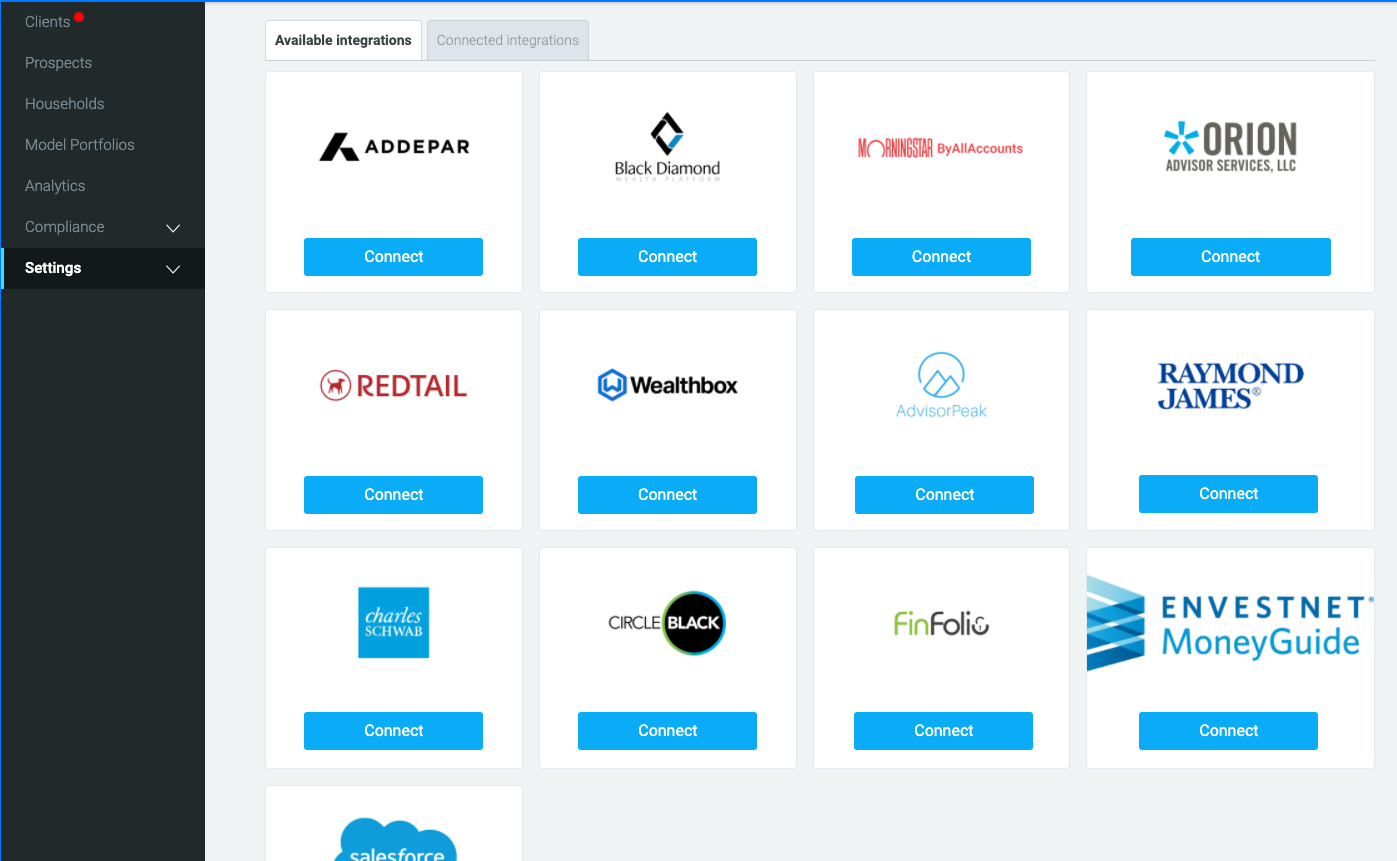

Connect Custodial Accounts With Smartria & StratiFi

Join our upcoming webinar to learn more about how StratiFi and Smartria can help you enhance your compliance consulting services.

Our experts will provide an overview of our integrated risk and compliance solutions, discuss best practices for implementation, and answer your questions about the partnership.

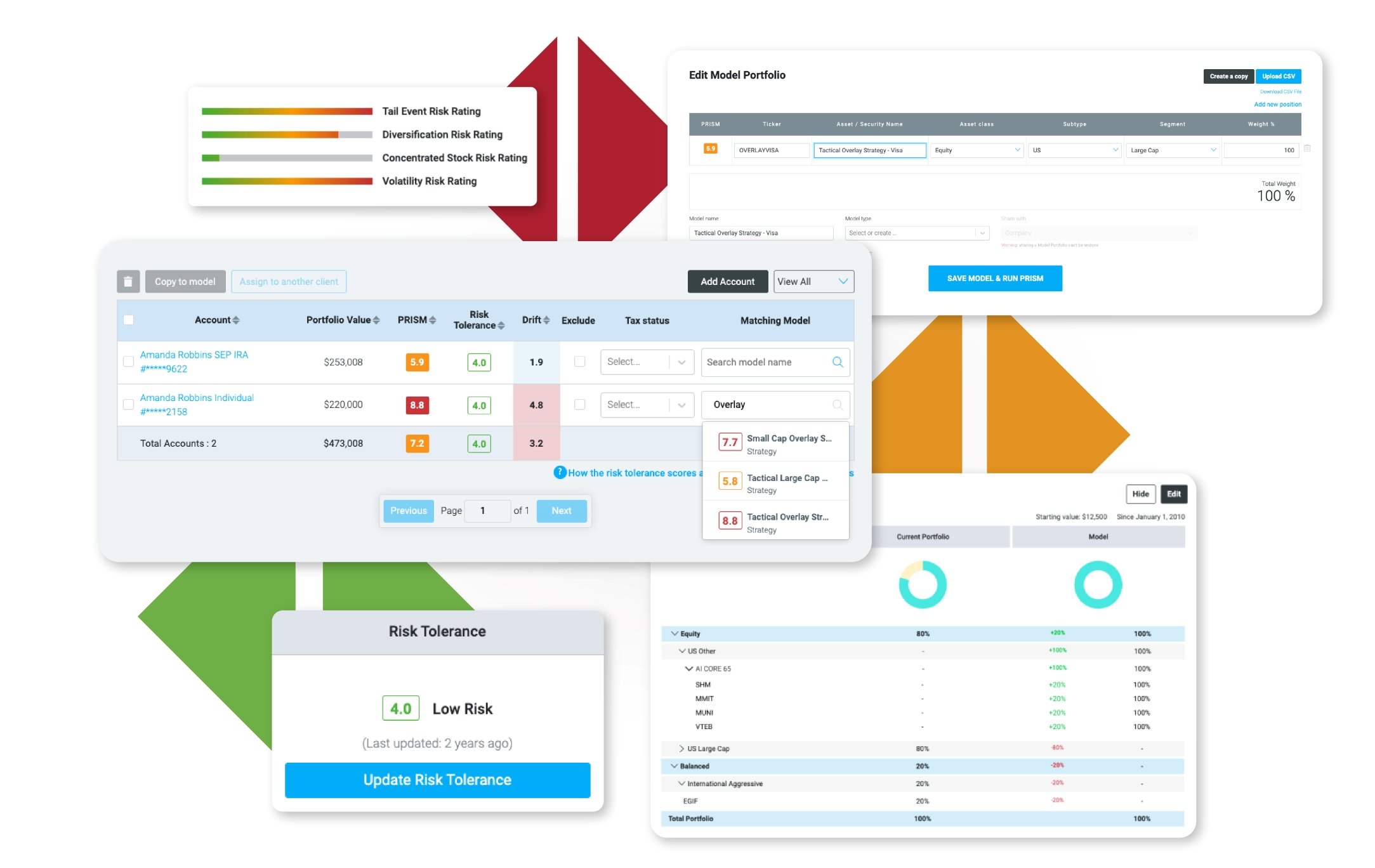

Get Risk, Allocation & Concentration Alerts

Seamlessly integrate your risk and compliance solutions to proactively manage potential risks and ensure regulatory compliance for your clients.

We will help you with the setup to sync data between the systems so you can get a full picture of portfolio risk at the enterprise level.

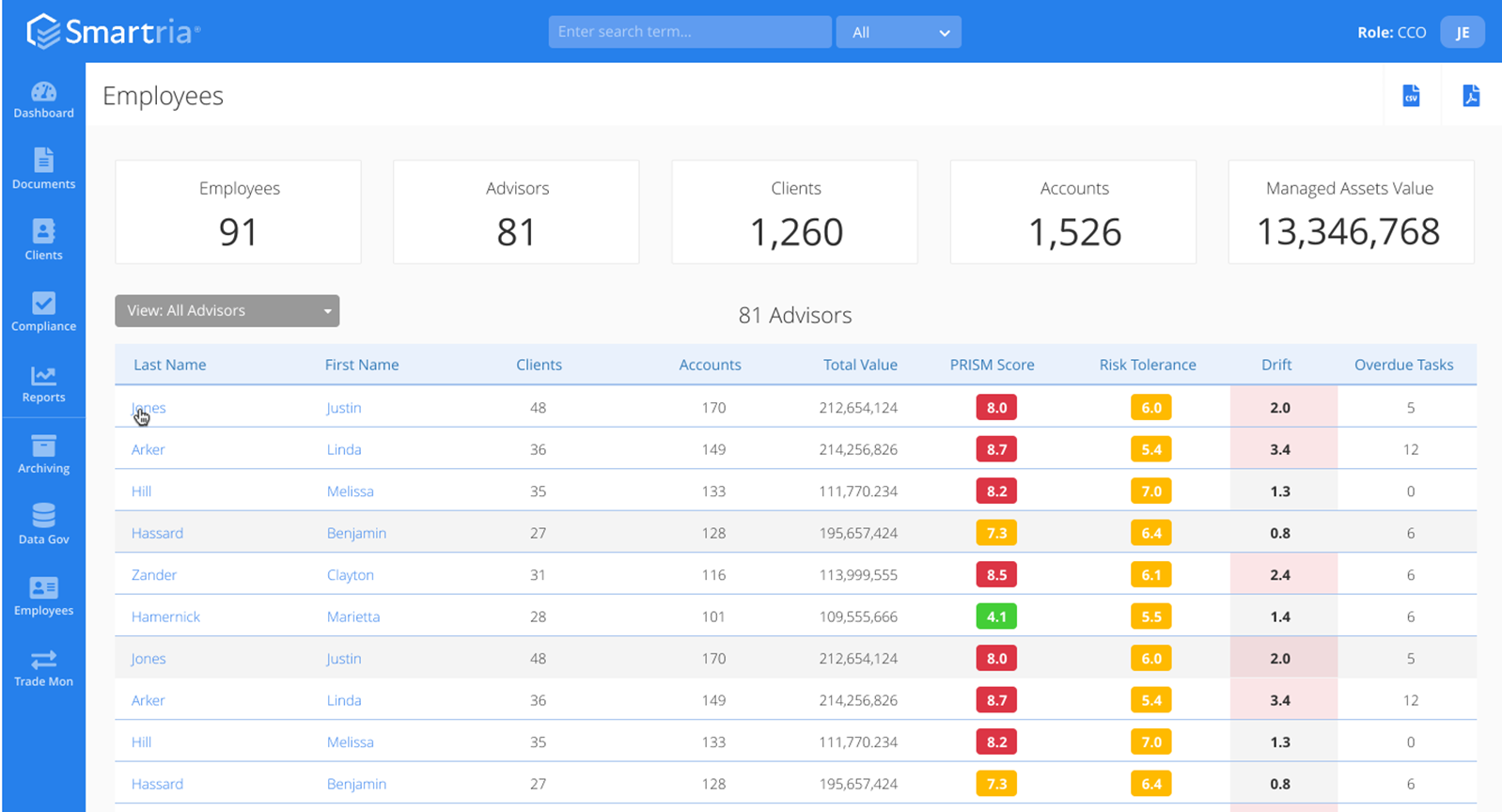

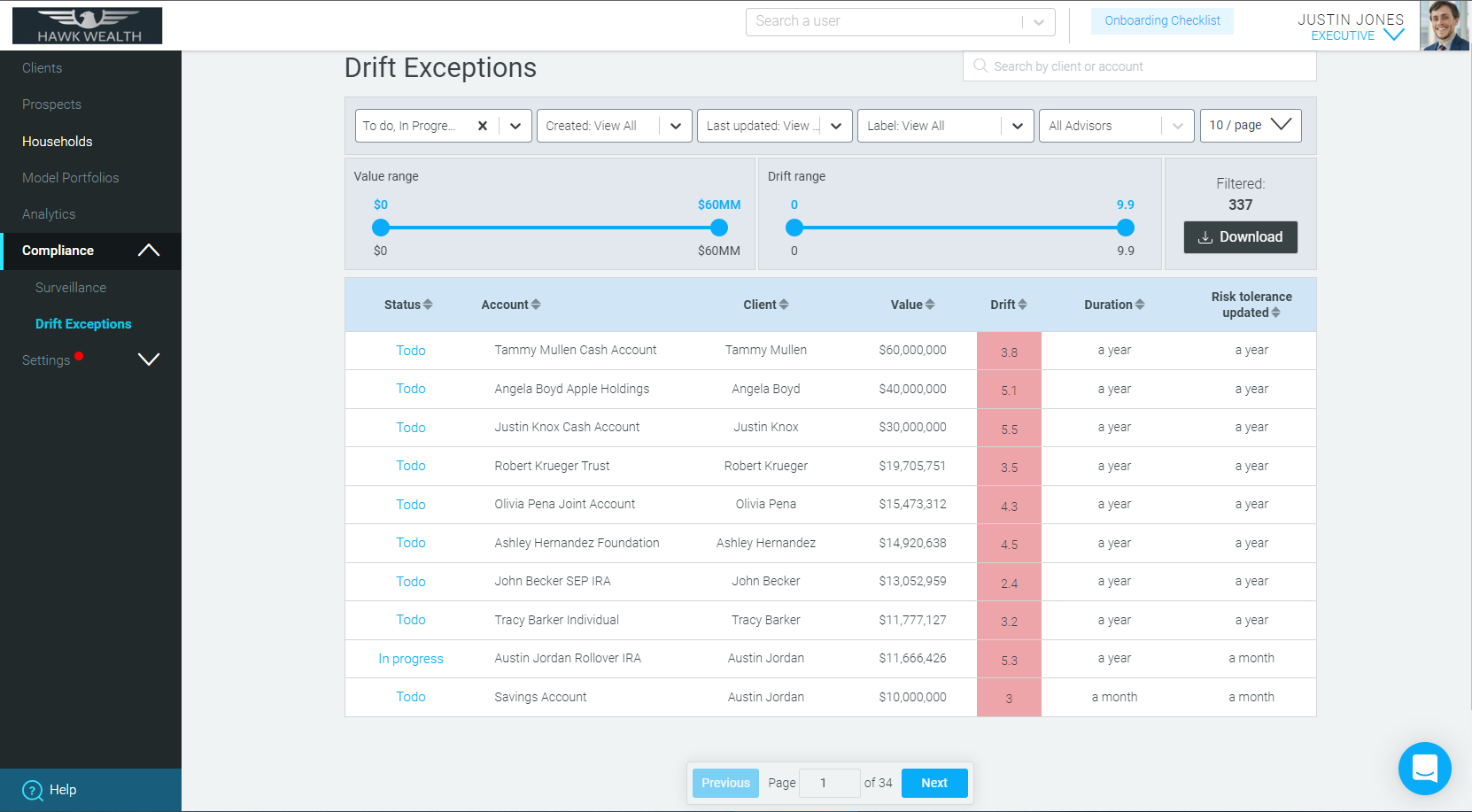

Automatically Monitor All Accounts Firm-Wide

Our exceptions dashboard gives you automated alerts and detailed information so you can start collaborating more effectively with financial advisors and wealth managers.

Our team will guide you through the implementation process and help you generate your first exceptions report so you can provide regulators with concrete evidence of supervision.

Say goodbye to manual reviews.

Your One-Stop Shop Compliance & Risk Dashboard

.png)

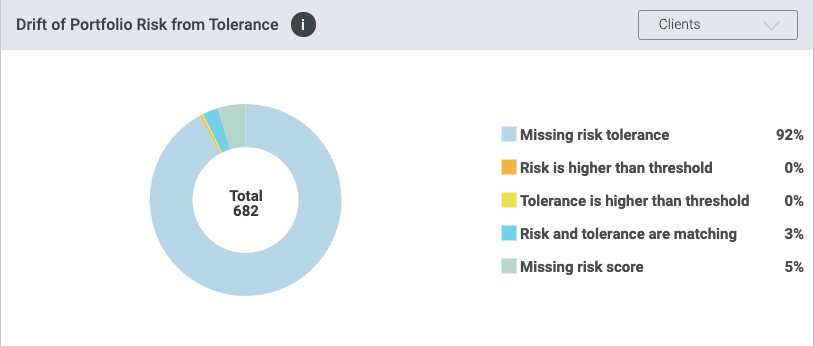

Proactive Surveillance Simplified

Automatically monitor accounts and eliminate manual reviews

Integrating risk and compliance solutions for proactive surveillance is a game-changer for financial advisors and compliance officers looking to streamline their risk management process.

The ability to automatically monitor thousands of accounts for various factors such as risk, and suitability, helps compliance teams stay ahead of potential risks, eliminate manual reviews and avoid costly fines.

Get alerts when risk, suitability, and position concentration levels breach thresholds

Risk, Suitability & Position Concentration Alerts help compliance officers and financial advisors monitor accounts whenever a threshold is breached.

Our system identifies accounts where there is a high concentration in a single type of investment such as a mutual fund, stock, bond, ETF, and more. By receiving alerts, you can quickly focus on accounts that require attention and take appropriate action to manage their risk exposure.

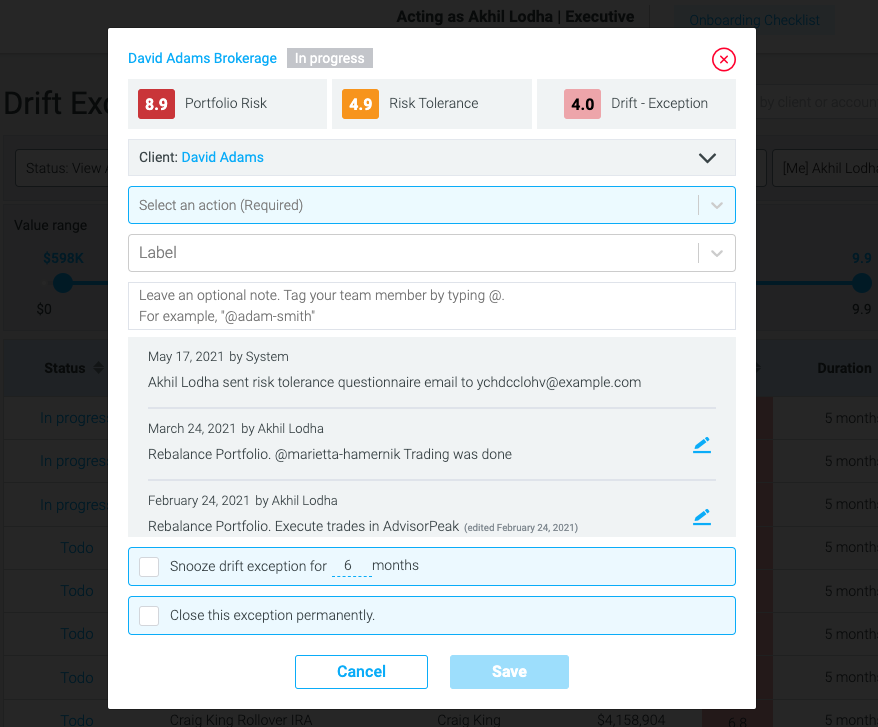

Collaborate with stakeholders to document exceptions & ensure regulatory compliance

A powerful platform that enables our users to collaborate on exceptions, using tagging, email alerts, and alert age tracking to stay on top of exceptions.

Compliance officers can easily tag advisors and teams on exceptions, generate email alerts and ensure that all parties are notified of any issues in a timely manner. Additionally, all activity is automatically documented, providing a detailed record that can be accessed as required by regulators.

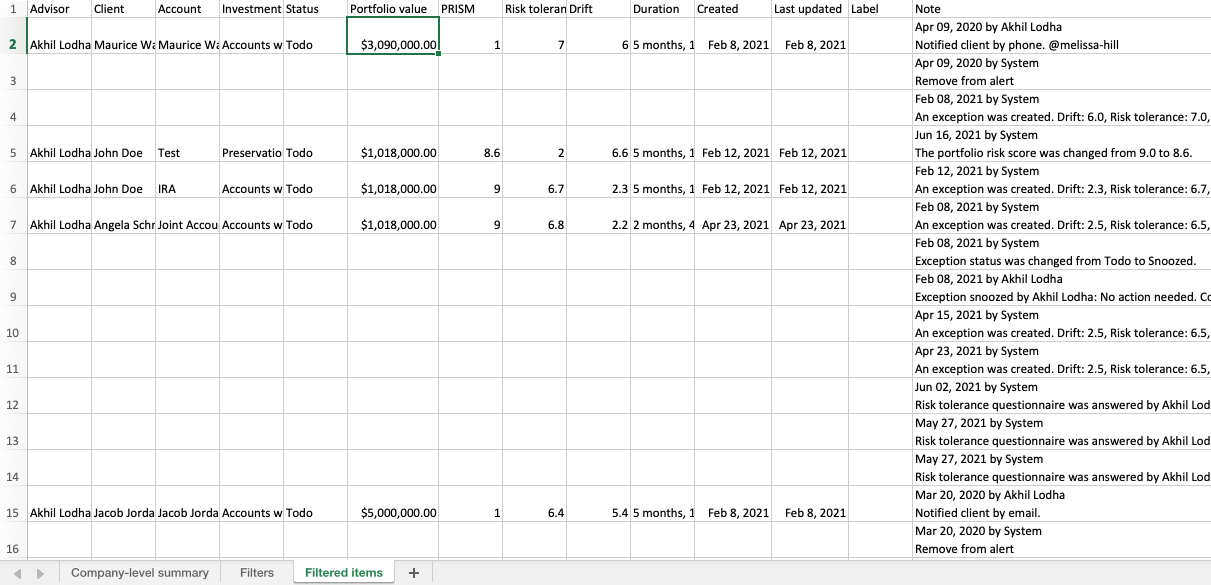

Document reviews and demonstrate proactive risk management and compliance

We provide compliance officers with an easy and effective way to document and file their compliance efforts using the platform's Excel export feature.

This feature allows our users to generate detailed reports of their compliance activity, including all exceptions, notes, and timestamps, which can be easily exported and saved for documentation and filing purposes.

"StratiFi is the perfect way to explain why you're recommending changes to a client's portfolio in a way that they can visually understand it."

“I like the investment proposal, compare, & analyze tools. Also the performance capability as well! Ultimately generating a proposal that also contains a risk assessment!”

As Featured In